House Prices

House Prices in Ipswich: Latest Data

4 minute read

Data Reviewed: May 2025

Source: UK House Price Index (UK HPI)

How much do homes in Ipswich cost?

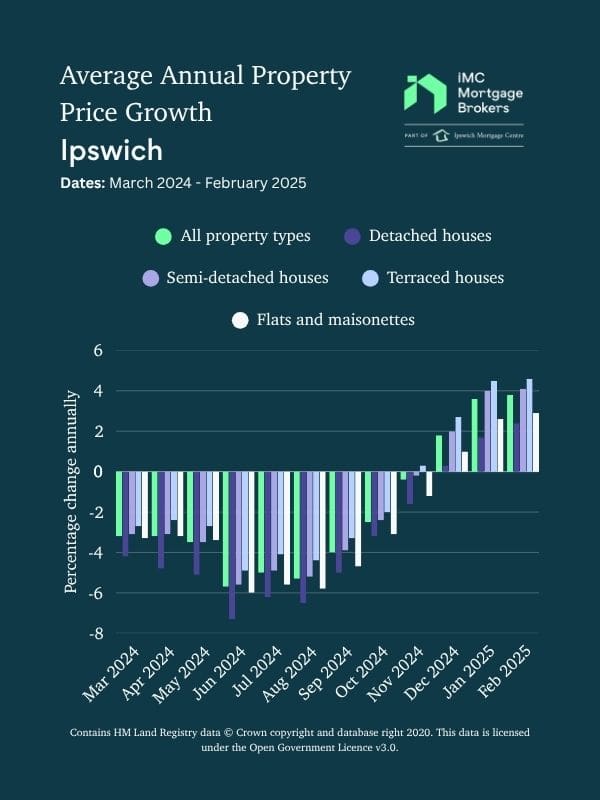

The average property price in Ipswich in February 2025 was £224,710, marking a 3.8% increase from the same time last year. Month-on-month, prices edged up by 0.4%.

This modest but consistent growth keeps Ipswich aligned with regional trends – just slightly behind the East of England’s 4.2% annual growth, and well below the UK average of 5.4%.

Headline figures for Ipswich (February 2025)

- Average Property Price: £224,710

- Monthly Price Change: +0.4% vs January 2025

- Annual Price Change: +3.8% vs February 2024

- Latest Sales Volume (December 2024): 90 sales

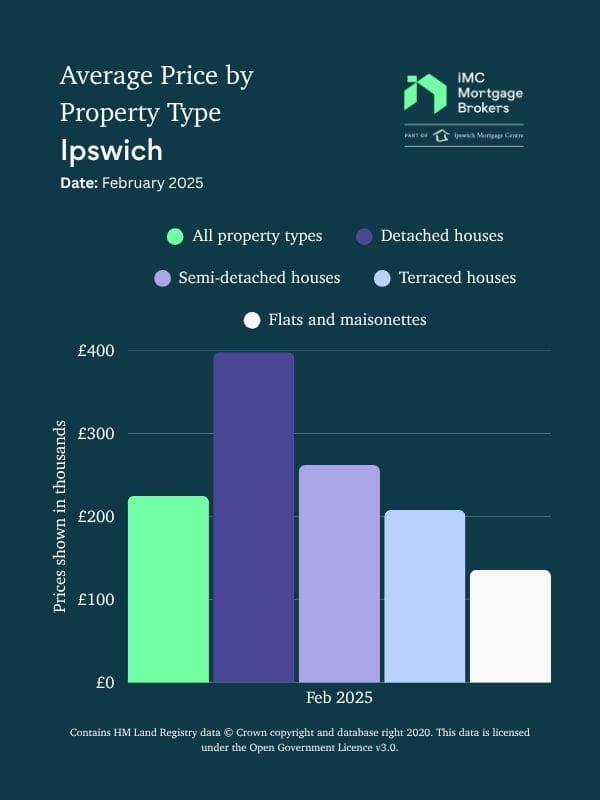

Property Type Breakdown

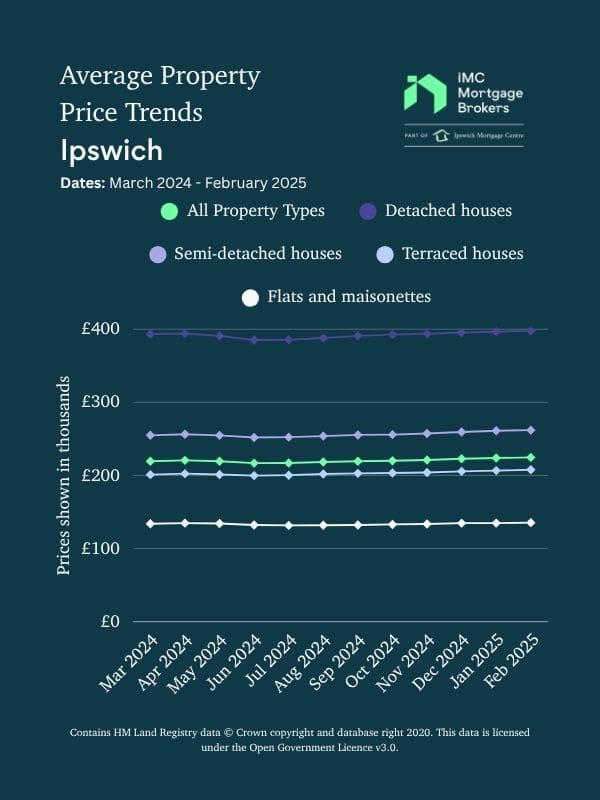

House prices in Ipswich continue to rise steadily, with the average property now priced at £224,710, up 0.4% month-on-month.

Terraced houses lead annual growth at 4.6%, followed by semi-detached at 4.1%. Flats and maisonettes saw a 2.9% increase, while detached homes rose 2.4% year-on-year.

Since mid-2024, all property types have shown consistent monthly gains, with strongest growth in the lower and mid-market segments – a sign of solid demand and affordability-driven movement.

| Property Type | Average Price | Monthly Change | Annual Change |

| Detached | £397,846 | +0.3% | +2.4% |

| Semi-detached | £261,952 | +0.3% | +4.1% |

| Terraced | £207,749 | +0.5% | +4.6% |

| Flats/Maisonettes | £135,502 | +0.5% | +2.9% |

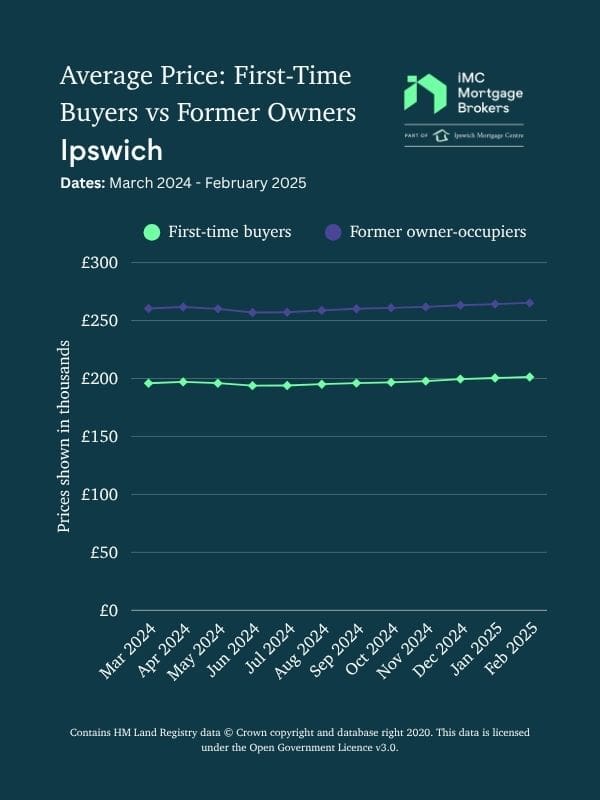

Buyer Type (First-Time vs Former Owner-Occupier)

First-time buyers in Ipswich are paying an average of £201,257, up 4.1% annually, while former owner-occupiers now pay £265,198, a 3.2% year-on-year increase. Both groups saw a 0.4% monthly rise.

Over the past year, first-time buyers have seen slightly faster price growth, reflecting strong demand in the entry-level market. Steady monthly increases since summer 2024 suggest continued market confidence across both buyer types.

| Buyer Status | Average Price | Monthly Change | Annual Change |

| First-Time Buyer | £201,257 | +0.4% | +4.1% |

| Former Owner Occupier | £265,198 | +0.4% | +3.2% |

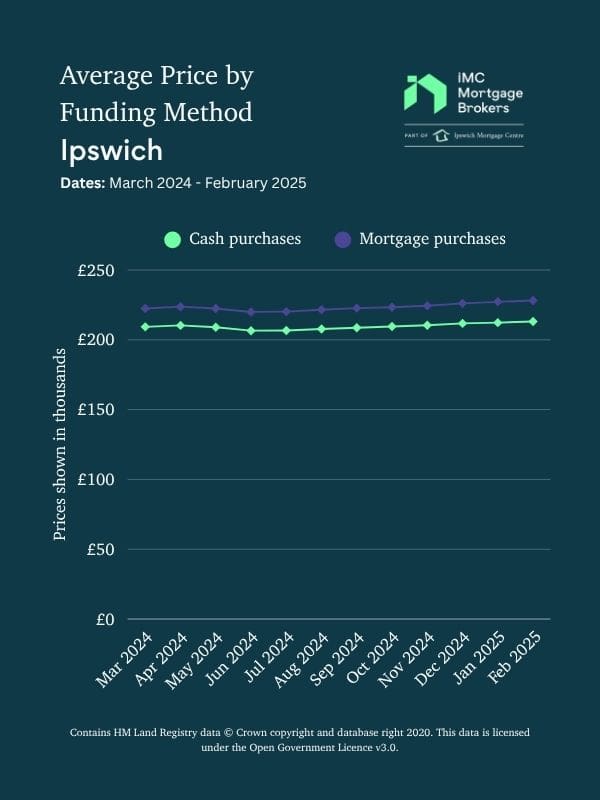

Funding Method (Cash vs Mortgage)

Average property prices rose for both mortgage-backed (£228,131) and cash purchases (£213,116) in February, each up 0.4% month-on-month. Annual growth was stronger for mortgage buyers (3.9%) compared to cash buyers (3.3%).

Mortgage purchases continue to dominate the market, accounting for 26 out of 32 sales in December 2024. This reflects ongoing buyer reliance on financing amid a stable lending environment.

| Funding Method | Average Price | Monthly Change | Annual Change | (Latest Sales Volume data: December 2024) |

| Mortgage | £228,131 | +0.4% | +3.9% | 26 |

| Cash | £213,116 | +0.4% | +3.3% | 6 |

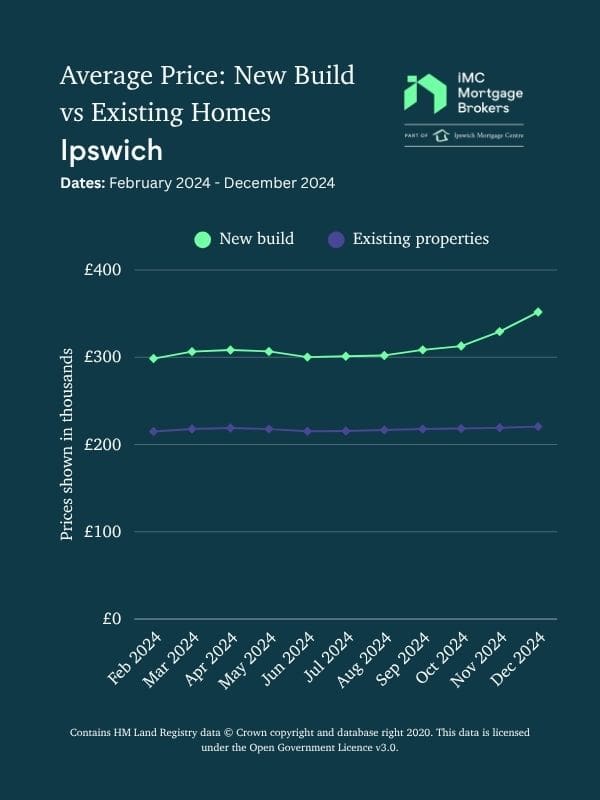

New Build vs Existing Homes

New build prices surged to £351,769 in December, a 6.8% monthly jump and 17.1% annual rise. In contrast, existing homes saw modest growth, up 0.6% monthly and 1.5% annually, with an average price of £220,490.

Despite the sharp rise in new build prices, sales volumes remain low (just 1 sale in July 2024) compared to 97 sales for existing homes, highlighting limited supply or uptake in the new build sector.

| Property Status | Average Price (Dec 2024) | Monthly Change (Dec 2024 vs November 2024) | Annual Change (Dec 2024 vs Dec 2023) | Sales Volume (July 2024) |

| New Build | £351,769 | +6.8% | +17.1% | 1 |

| Existing Homes | £220,490 | +0.6% | +1.5% | 97 |

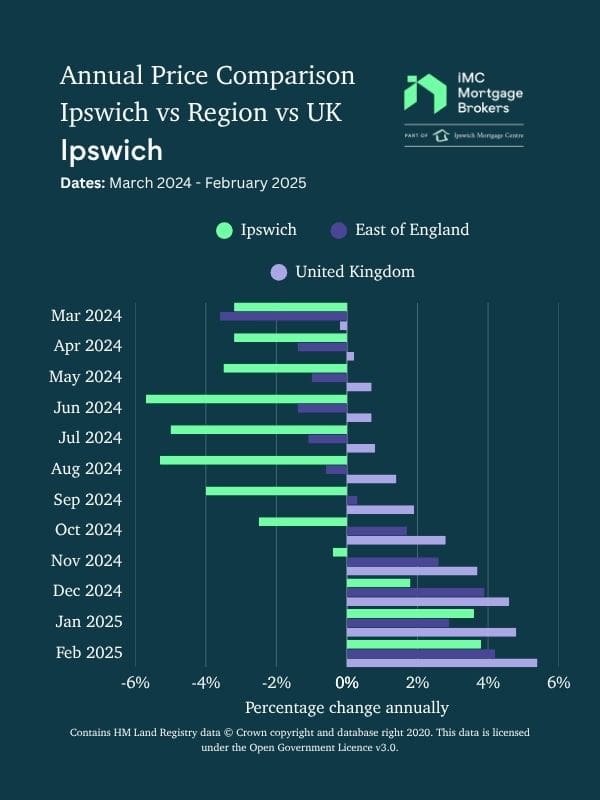

Ipswich vs East of England and UK

House prices in Ipswich rose 3.8% year-on-year to £224,710, slightly below the East of England (4.2%) and the UK average (5.4%).

While Ipswich lagged behind earlier in 2024, its recovery gained pace in late autumn, closing the gap with regional and national trends. The market now shows healthy, consistent growth in line with broader improvements across the UK housing sector.

| Area | Average Price | Annual Change |

| Ipswich | £224,710 | +3.8% |

| East of England | £338,468 | +4.2% |

| United Kingdom | £268,319 | +5.4% |

What this means if you’re buying in Ipswich

If you’re looking to buy in Ipswich:

- Entry-level properties are seeing the most price growth, so acting sooner may help avoid further increases.

- Mortgage buyers dominate, which means getting a mortgage agreement in principle early could strengthen your position.

- Existing homes remain the most accessible option, both in price and availability.

As a mortgage broker, we can help you understand your affordability, compare options, and move quickly when the right property comes up.

Data Source and Usage

This analysis is based on the UK House Price Index (UK HPI), compiled from Land Registry, Registers of Scotland, and Land & Property Services Northern Ireland data. It is published monthly by HM Land Registry.

Contains HM Land Registry data © Crown copyright and database right 2020. This data is licensed under the Open Government Licence v3.0.

- Figures are provisional for recent months and may be revised.

- Sales volume data typically lags further behind price data.

- Data is not adjusted for inflation.

- Local figures can be more volatile due to smaller sample sizes.